Imagen: Freepik

Imagen: Freepik

Tax developments in corporate income tax for the 2025 fiscal year

Corporate Income Tax (IS) is one of the most relevant taxes in the Spanish tax sphere, generally affecting all entities operating in the national territory.

With the entry into 2025, various tax reforms will be implemented, mainly introduced by Law 7/2024 and Royal Decree-Laws 9/2024 and 10/2024, which are of great importance given the significant impact they may have on the companies and entities subject to their application.

That is why, in this article, we are going to highlight the main changes to the IS that will come into force from this tax year onwards.

Complementary tax to ensure an overall minimum level of taxation for multinational groups and large domestic groups.

Law 7/2024 transposes into national law the European Directive guaranteeing a global minimum taxation of 15% for large multinational and national groups.

The Complementary Tax aims to ensure that large multinational and domestic groups are taxed at least 15% of their income in each jurisdiction in which they operate, in line with the principles of OECD Pillar 2. The structure of this tax is made up of three forms:

- National tax: Taxes constituent entities based in Spain whose income is subject to an effective rate of less than 15%.

- Primary tax: Applies to income generated by foreign group entities attributed to the Spanish parent company, provided that this income does not reach the minimum rate.

- Secondary tax: Covers profits insufficiently taxed abroad when the primary rule is not sufficient.

- Taxable income: This is calculated on the basis of accounting profit adjusted in accordance with accepted international financial accounting standards, including adjustments such as the exclusion of income linked to economic substance.

- Exclusions: Jurisdictions with revenues of less than €10 million or profits of less than €1 million will be exempt from this tax.

- Transitional Period: The 1st and 3rd Transitional Provisions establish rules for deferred taxes and a gradual implementation until 2032.

Capitalisation reserve in the Corporate Income Tax Law

Various amendments are also made to Article 25 of the LIS regarding the capitalisation reserve, effective for tax periods beginning on or after 1 January 2025.

These amendments are in addition to those already approved in Royal Decree-Law 4/2024, which came into force for tax periods commencing on or after 1 January 2024. It should be recalled that these amendments consisted of increasing the percentage reduction on the increase in equity, from 10% to 15%, and reducing the period for maintaining this increase from 5 to 3 years.

However, as regards the novelties introduced by Law 7/2024, two main changes stand out:

New increase in the percentage reduction applicable to the increase in own funds

This percentage, which is currently 15%, will be adjusted according to the following conditions:

- In the absence of an increase in the total average workforce of the taxpayer in the tax period, with respect to the previous period: 20%.

- In the event of an increase in the total average workforce, compared to the previous tax period, and which is maintained for a period of 3 years from the end of the corresponding tax period: – 23% if the increase in the workforce is between 2% and 5%. – 26.5% if the increase in the workforce is between 5% and 10%. – 30% if the increase in the workforce exceeds 10%.

Increase of the ceiling of the reduction for capitalisation reserve

- It is raised from the current 10% of the positive tax base of the tax period (prior to the integration referred to in Article 11.12 and the offsetting of tax losses) to the following limits: – 20% in general. – 25% in the case of micro-enterprises (taxpayers whose taxable income is less than 1 million euros during the 12 months prior to the start of the corresponding tax period).

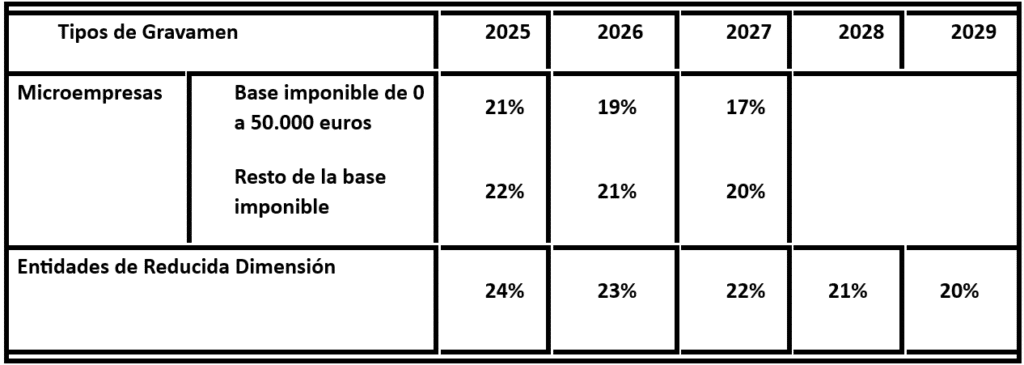

New corporate income tax rates for micro-enterprises and small companies

The tax rate applicable to micro-companies (INCN< €1,000,000) and small entities (INCN< €10,000,000) is reduced, provided that they are not considered as a capital entity.

However, it is foreseen that the implementation will be carried out progressively in accordance with the transitional regime approved together with this provision, so that the following tax rates will apply in each of the coming years:

Based on this amendment, the minimum taxation rule of art. 30 bis of the LIS is also adapted to this type of entity, establishing a minimum taxation percentage to be calculated by applying fifteen twenty-fifths of the corresponding tax rate, rounding up.

Reincorporation of tax measures of Royal Decree Law-3/2016 that were declared unconstitutional.

Recovery of more restrictive limits for the clearing of BINs by large companies

For these purposes, large companies are considered to be those whose net turnover during the 12 months prior to the date on which the tax period begins is at least 20 million euros.

The following limits are reinstated:

- 50%, when the INCN of the previous 12 months has been greater than or equal to 20 million euros, but less than 60 million euros.

- 25%, when INCN has been greater than or equal to 60 million euros.

Reintroduction of specific limitation on the application of double taxation deductions

A maximum deduction of 50% of the taxpayer’s gross tax liability is also established for large companies, and this limitation affects both deductions generated in the tax period itself and those pending from previous years.

Recovery of the impairment reversal rule

The obligation to reverse impairment losses on securities representing holdings in the capital or equity of entities, which have been tax deductible in the taxable base for IS in tax periods commencing prior to 1 January 2013 and which are pending reversal at 1 January 2024, is reintroduced.

The provision stipulates that the reversal shall be made, in equal parts, in each of the first three financial years beginning on or after 1 January 2024.

Extension of the restriction on the offsetting of tax losses in tax consolidation for corporate income tax purposes.

The restriction on offsetting tax losses in the tax consolidation regime is extended for tax periods starting in 2024 (provided that they have not ended before 22/12/24) and in 2025.

This measure, which was already in force in 2023, prevents groups taxed under this regime from including 50% of the tax losses of the entities forming part of the group in their consolidated tax base.

The amounts not computed shall be integrated in tenths in successive periods starting on or after 1 January 2025 and 1 January 2026, under conditions similar to those applied to the tax loss carryforwards for 2023.

The limitation in 2024 and 2025 will not affect foundations that are part of a tax group.

Do you need advice? Access our area related to corporate taxation of companies;