Image: Freepik

Image: Freepik

Economic activity and property entity in the Corporate Income Tax Law

Economic activity for corporate income tax purposes

The concept of economic activity within a company can have important consequences with regard to the personal taxation of the individual partner, mainly in the Wealth Tax or in the Temporary Solidarity Tax on Major Fortunes, as well as in Inheritance and Gift Tax, determining the little or no taxation of such business assets provided that certain requirements are met.

Notwithstanding the above, in this article we will focus on the concept of economic activity and asset-holding entity regulated in the Corporate Income Tax Act, and the possible consequences of its classification with respect to this tax.

Thus, in accordance with the provisions of Article 5 of the Corporate Income Tax Act, economic activity is defined as ‘the organisation on one’s own account of the means of production and human resources, or one or both, for the purpose of engaging in the production or distribution of goods or services’.

Article 5 continues with a special reference to the specific economic activity of letting property.

When is an entity considered to have a patrimonial character and not to be engaged in an economic activity?

For the purposes of delimiting when there is no self-management of means of production and/or human resources and, consequently, no economic activity, Article 5 of the Corporate Income Tax Act establishes the concept of an asset-holding entity.

This concept is highly relevant because these entities, as they are not considered operational, are excluded from the application of certain schemes and incentives, as will be discussed below.

The aforementioned provision considers that an entity has a patrimonial nature when more than half of its assets are made up of securities, or are not assigned to an economic activity.

What are the ‘securities’ of an entity’s assets?

The term securities refers to all financial instruments that can be traded on securities markets.

However, Article 5 stipulates that the following are not considered to be securities and, consequently, would count as assets assigned to the activity:

a) Those held in order to comply with legal and regulatory obligations.

b) those embodying debt claims arising from contractual relations established as a result of the pursuit of economic activities.

c) those held by securities companies as a result of the exercise of the activity constituting their object. The main function of these companies is to act as intermediaries in the securities market, either for their own account (investing directly) or for the account of others (managing investments for third parties). For them, securities are the equivalent of what stocks or goods are for other commercial or industrial enterprises, i.e. they are the core of their economic activity. For this reason, such securities do not count as such and are considered to be used for the activity of these companies.

d) Those that grant at least 5 per cent of the capital of an entity and are held for at least one year, for the purpose of directing and managing the holding, provided that the corresponding organisation of material and personal resources is in place. This condition shall be determined taking into account all the companies forming part of a group of companies.

As can be seen, the requirements on this point are very similar to those established in the Wealth Tax Act to determine the exemption of shares in companies from wealth tax.

What assets are considered to be used for the economic activity of the company?

This is where there is most conflict, especially in the case of financial assets that may be considered ‘idle’ or not destined for activity in the medium term.

However, the aforementioned Article 5 expressly admits the consideration as an assigned asset of ‘money or credit rights arising from the transfer of assets assigned to economic activities or securities (which count as an assigned asset), carried out in the tax period or in the two preceding tax periods’.

This measure attempts to mitigate to some extent the effects of a possible ‘supervening wealth’ due to the accumulation and accumulation of surplus cash. However, the regulation of this surplus wealth in the IS differs notably from that contained in the Wealth Tax Law due to the fact that, on the one hand, in the IS only money or credits arising from the transfer of tangible assets or non-computable securities are excluded from the calculation, whereas in the IP all assets deriving from profits obtained from economic activities (including dividends, which are not included in the IS) can be left out of the calculation. On the other hand, the period taken into account in the IS (two years) is considerably shorter than that set in the IP (ten years).

It is therefore very important to periodically review the composition of the company’s assets. As can be deduced from the above, if cash or financial assets from the sale of qualifying assets are tied up for more than two years, they would be considered as part of the unaffected assets for the purposes of possible consideration as an asset-holding entity.

From the analysis of the doctrine of the Directorate General for Taxation applicable to the case analysed, we must interpret that, in addition to the cash or credit rights deriving from the transfer of assigned items, cash generated as a result of the development of the activity itself (even if it does not derive from the transfer of assets) will also be counted as an assigned asset. This is the conclusion of, among others, VC 232/2023, which, however, considers that cash and financial assets deriving from dividends distributed by investees do not, as a general rule, count as assets assigned to the activity.

In short, it is critical to adequately control the existing proportion of tangible and intangible assets in order to avoid uncontrolled surplus assets that could lead to undesired tax consequences and high unforeseen tax costs (for example, as we shall see, in the case of the transfer of company shares).

How is the ratio of assets assigned to the company’s economic activity to assets not assigned to its economic activity computed?

As the provision states, the value of assets, securities and assets not assigned to an economic activity will be that which is deducted from the average of the entity’s quarterly balance sheets for the financial year (again, this differs from the calculation of the assets assigned for the purposes of the application of the IP exemption).

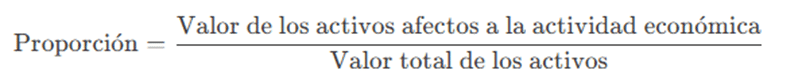

The ratio is calculated by dividing the value of the assets assigned to the economic activity by the total value of the company’s assets. The formula is as follows:

This result is expressed as a percentage and is used to determine how much of the company’s income or expenditure is linked to the economic activity.

Calculation of the ratio for corporate groups

In the case of companies forming part of a commercial group, the consolidated balance sheet of the group, and not only the individual balance sheet of the company, shall be taken into account for the purposes of calculating the proportion between assigned and non-assigned assets.

However, the interpretation of the General Directorate for Taxation in the aforementioned consultation, echoing previous pronouncements, states that ‘no entity that forms part of a group shall be considered a holding company if, in the average of the quarterly consolidated balance sheets for the financial year, more than half of the assets are assigned to economic activities’, regardless of whether any individual entity of the group can be considered a holding company.

This is important to bear in mind when controlling the computation and the proportion affected-non-affected, as it could be the case that a company could be considered individually as an asset-accruing company and yet, in accordance with the above criterion, escape this consideration.

Main consequences of equity ownership. Special mention of the exemption for the transfer of company shares in Article 21.3 of the Corporate Income Tax Act.

Apart from the consequences that may arise in other taxes, the consideration of an entity as an asset-holding company may entail significant undesired consequences in corporate income tax, such as the impossibility of applying certain tax incentives in corporate income tax. These include, mainly and among others, the non-application of the regime for small entities (art. 101 et seq. LIS), the impossibility of offsetting tax losses in certain cases (art. 26.4.c) of the LIS), or the impossibility of applying the reduced tax rate for newly created entities (art. 29.1 LIS).

In the case of the sale of shares by a shareholder who is a legal entity, the gain from the sale may be exempt from tax at a rate of 95% in accordance with Article 21 of the LIS and subject to certain requirements.

However, if the company being transferred is considered as an asset-holding company, the part of the positive income corresponding to the increase in the undistributed profits of the asset-holding company generated during the entire time the holding is held is exempt at 95%, while the rest of the income obtained is included in the taxable base without exemption.

If this has not been properly reviewed at the time of the sale of a company or part of its share capital, the capital gains generated may be fully taxable in the case of uncontrolled supervening wealth.

This point has generated controversy, especially in cases where the company being sold has carried out preparatory acts for the commencement of an activity to be continued by the purchaser, but the existence of economic activity at the precise moment of the sale is doubtful.

Although administrative doctrine has admitted the application of the exemption in some of these cases, this is an unresolved and highly casuistic issue, and it is therefore essential to analyse each case in detail.

Recommendations for the delimitation between economic activity and asset holdings

Documentation and proof: it is crucial to have employment contracts, detailed accounting, justification of the need for cash flow and records of investments proving the link with the economic activity.

Group planning and structure: for example, if it is decided to concentrate personnel resources in a single group entity, the provision of services to the other companies and the integration of assets for accounting purposes should be recorded.

Periodic review: the circumstances of the company (or group) may change over time (e.g. increase in liquidity, divestment of related assets), so it is advisable to check the situation periodically to avoid the consideration of an asset-holding entity on an ad hoc basis.

In short, the demarcation between economic activity and mere holding of assets is decisive for correct corporate income taxation. The existence of contracted staff, the reinvestment of profits in the business itself and the coordination of resources within a corporate group are key factors that allow entities to access the different tax regimes and incentives provided for in current legislation.

Do you need advice? Access our area related to the economic activity and patrimonial entity in the Corporate Tax Law: